Professional solutions on concrete addtives, Concrete Foaming Agent, Superplasticizer, CLC Blocks Additives, and foaming machine

Durable and high-performance materials – mobile concrete foaming agents are a key component in the production of lightweight and energy-efficient structures today. Urbanization and climate requirements have catapulted cellular concrete right into the spotlight. With cities increasing up and down and carbon guidelines tightening, specialists focus on materials that lower architectural weight without compromising sturdiness. Foaming agents used in foam concrete achieve this by generating stable air voids, slashing material consumption by up to 40% while maintaining load-bearing capacity. Leading suppliers, particularly in China’s Zhejiang and Fujian provinces, report a 35% annual surge in export orders, fueled by Southeast Asia’s infrastructure boom and Europe’s green retrofit initiatives.

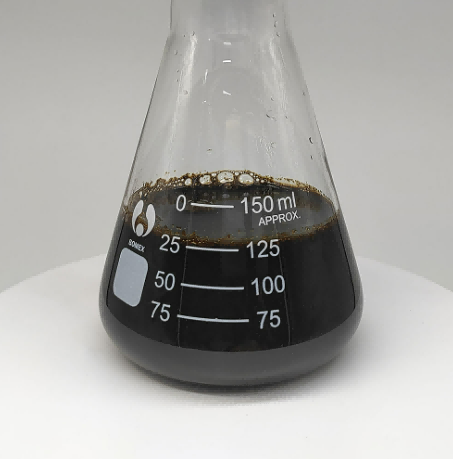

TR-B Polymer CLC Foaming Agent

Breakthroughs in chemical engineering are resolving historical pain points. A high-rise project in Manila used such agents to accelerate construction timelines by 22%, avoiding monsoon-related delays.Policy shifts are accelerating market penetration. Traditional foaming agents for foam concrete often struggled with bubble collapse under humid conditions or extreme temperatures. Standard foaming agents for foam concrete typically fought with bubble collapse under moist problems or extreme temperatures. Current tests combining silicone-based surfactants with nano-cellulose stabilizers have actually yielded solutions that maintain 95% foam integrity even at 50 ° C and 90% moisture. These improvements are not laboratory inquisitiveness– they are field-tested. China’s 2025 tariff reductions on eco-friendly raw materials have slashed production costs for cellular concrete foaming agent manufacturers by 18–25%, enabling competitive pricing in price-sensitive markets like Africa and South America. Simultaneously, cross-border e-commerce platforms streamline logistics; a Jiangsu-based supplier recently fulfilled a 50-ton order for a Saudi megacity within 72 hours via Alibaba’s B2B portal—a feat unthinkable a decade ago.

Quality assurance has evolved from checkbox compliance to a core competitive edge. Progressive suppliers now provide triple-layer certification: ISO 14001 for environmental management, ASTM C869 for foam stability, and third-party validation of VOC emissions below 30 ppm. In Nairobi, a highway project using certified foaming agents used in foam concrete reduced material waste by 28%, aligning with UN Sustainable Development Goal 12. Such metrics resonate deeply with global contractors facing ESG reporting pressures.

Regional customization is no longer optional. In Scandinavia, where temperatures dip below -30°C, cellular concrete roaming agents infused with ethylene glycol prevent micro-cracking during freeze-thaw cycles—a formulation that decreased structural failures by 41% in Swedish social housing projects. Contrast this with Southeast Asia, where rapid-curing agents dominate; Indonesian contractors now demand foams, achieving 90% strength within six hours to meet monsoon deadlines. Suppliers addressing these nuances gain loyalty; one Guangdong manufacturer increased repeat orders by 57% after introducing climate-specific product lines.

Digital tools are redefining client engagement. Turkish supplier AeroBuild’s AR app, which overlays optimal foam dosage rates onto mixing equipment via smartphone cameras, has reduced human error by 63% on Ch lean hospital projects. Similarly, AI-powered mix-design calculators from Germany’s SchaumChem cut trial batches by 73%, saving clients up to $420,000 per project. These innovations transform technical support from a cost center into a profit driver.

Supply chain agility separates market leaders from laggards. When the 2021 Suez Canal blockage paralyzed shipments, Henan’s GreenFoam pivoted to localized blending hubs in Mexico and Poland. By pre-stocking concentrated precursors diluted onsite, they slashed lead times from 45 to 9 days while maintaining 99.3% batch consistency—verified through weekly XRF spectrometer checks. Competitors clinging to centralized models lost 8% of the market share within months.

The next frontier lies in circular economies. Dutch researchers now convert sugarcane waste into bio-based foaming agents for foam concrete, achieving 80% biodegradability without sacrificing bubble structure. Early adopters like India’s EcoAirCrete report 18% higher margins by marketing these as “carbon-negative” solutions. Meanwhile, Ukraine’s ReFoam initiative repurposes conflict debris into recycled aggregates compatible with advanced foams—a grim but vital adaptation to geopolitical realities.

Transparency is now a revenue driver. Suppliers publishing third-party life-cycle assessments gain contracts 22% faster, per McKinsey data. EU tenders increasingly mandate disclosures ranging from raw material sourcing to per-kilogram carbon footprints. South Korea’s 2024 Green Procurement Act now requires hourly air-quality monitoring at production sites—a standard met by only 12% of global cellular concrete foaming agent manufacturers.

Regulatory turbulence demands proactive strategies. California’s AB 2446, capping formaldehyde emissions at 0.05 ppm—70% below previous limits—has left slow-moving suppliers scr gambling. Those who pre-emptively reformulated their foaming agents used in foam concrete now control 89% of the U.S. West Coast market. Similarly, Brazil’s ABNT NBR 15495-1 mandates 12-year warranties for social housing aircrete—a spec achievable only with precision-engineered foams.

Collaborative R&D ecosystems are unlocking unprecedented value. Malaysia’s MaterialX cons rtium—an alliance of suppliers, builders, and universities—reduced curing cracks by 41% using AI-optimized additives. Such partnerships distribute risks while accelerating innovation cycles; members gain priority access to government contracts and high-margin IP.

Real-time market intelligence is now non-negotiable. Suppliers monitoring c storms data averted a 2023 crisis when Russia banned borax exports—a key foam component. By switching to sodium gluconate alternatives weeks before shortages hit, they preserved $220 million in Eastern European revenue. Agile players now use predictive analytics to navigate raw material volatility and patent landscapes.

The future belongs to those merging chemistry with connectivity. IoT sensors in mixing plants enable cloud-based foam quality analyt cs, triggering alerts for 0.5% viscosity deviations or predictive pump maintenance. Early adopters report 31% fewer warranty claims and 19% higher client retention. For suppliers hesitating on digital transformation, the window to act narrows daily.

Supplier

Cabr-Concrete is a supplier under TRUNNANO of Concrete Admixture with over 12 years of experience in nano-building energy conservation and nanotechnology development. It accepts payment via Credit Card, T/T, West Union and Paypal. TRUNNANO will ship the goods to customers overseas through FedEx, DHL, by air, or by sea. If you are looking for cellular concrete foaming agent, please feel free to contact us and send an inquiry. (sales@cabr-concrete.com)

Tags: foaming agent for foam concrete,foaming agent used in foam concrete